PJSC VimpelCom offers integrated mobile and fixed-line telephony services, international and national communication, data transfer, telematic services, and Internet access under the Beeline trademark in almost all regions of Russia and six countries of the CIS; it is one of “The Big Three” mobile operators in Russia.

Ex Libris Agency provides comprehensive media measurement support to the Beeline brand. We have designed the KPI framework for the company employees and measure it along with other metrics on a regular basis. On top of that, a suite of products for monitoring the social media space has been designed (including general reviews, thematic community efficiency, reviews of recommended platforms, socio-demographical analysis, monitoring studies, and dashboards).

VimpelCom Ltd.’s PR communications efficiency assessment covered 2H14. To analyze the media coverage leading international outlets of Reuters, Bloomberg, FT, and WSJ scale as well as several Tier 1 national media (in countries of the company presence) were selected. The assessment and “coding” of sentiment, a quality metric, was performed by media analysts with the focus on assumed interests of stock market players.

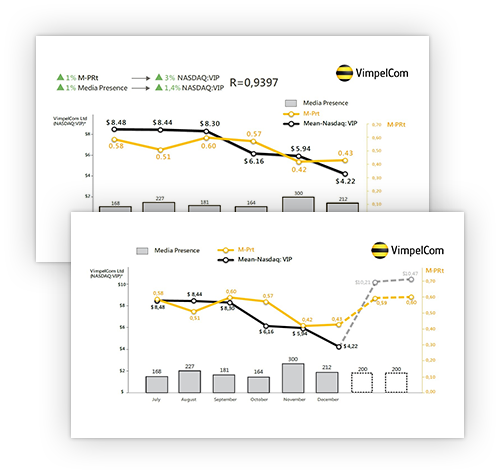

That resulted in a two-factor nonlinear regression model with R = 0.9397 correlation ratio between media indicators and a business metric built to demonstrate the correlation between monthly-average PRT (M-PRT) and Media Presence with fluctuations of the company stock price on the NASDAQ.

In order to find the PRT calculation formula that would be more sensitive to stock fluctuations, we came up with the second version of the PRT framework: The integral metric was decompounded (into factors including sentiment and positioning, the brand coverage density, report visibility, the level of a source influence, speaker activity, coverage genres, etc.) to further build a multiple regression model. That allowed ranging all the factors by their importance and the ratio of correlations with the international telco stock value on the NASDAQ.

After recalibrating the calculation model (mainly focusing on sentiment and positioning ratios), we spotted statistically more important relationships among M-PRT, Media Presence, and stock quotations (on the NASDAQ): The correlation ratio was 93.97% (it was less than 50% before, and over 90% after).

According to confidence intervals for 2H14 data, with Media Presence having grown by 1%, the value of VimpelCom Ltd. assets added 1.4% on average, while with a 1% M-PRT increase, the quotations grew 3% (from +0.89% to +5.09%).

Therefore, as we see it, the second PRT framework, in which factors correlate with the stock prices at 94% correlation ratio, is viable, while the framework itself is rather promising for similar short-run studies (with weaknesses and limitations well accounted for).